Gas markets as the key driver

Natural gas prices sit at the center of this story. The U.S. remains heavily reliant on natural gas, which provides about 40% of total electricity generation. According to the EIA, Henry Hub spot prices averaged $2.20 per million British thermal units (MMBtu) in 2024 but are forecast to rise to $4.00 in 2025 and $4.90 in 2026. This doubling in just two years reflects strong LNG export demand and flat domestic production growth. U.S. LNG exports are expected to climb from 12 billion cubic feet per day (Bcf/d) in 2024 to 16 Bcf/d in 2026, equaling a significant share of domestic consumption. With gas-fired plants typically setting the marginal price in wholesale markets, these fuel costs directly flow into higher electricity prices for consumers.

The demand challenge

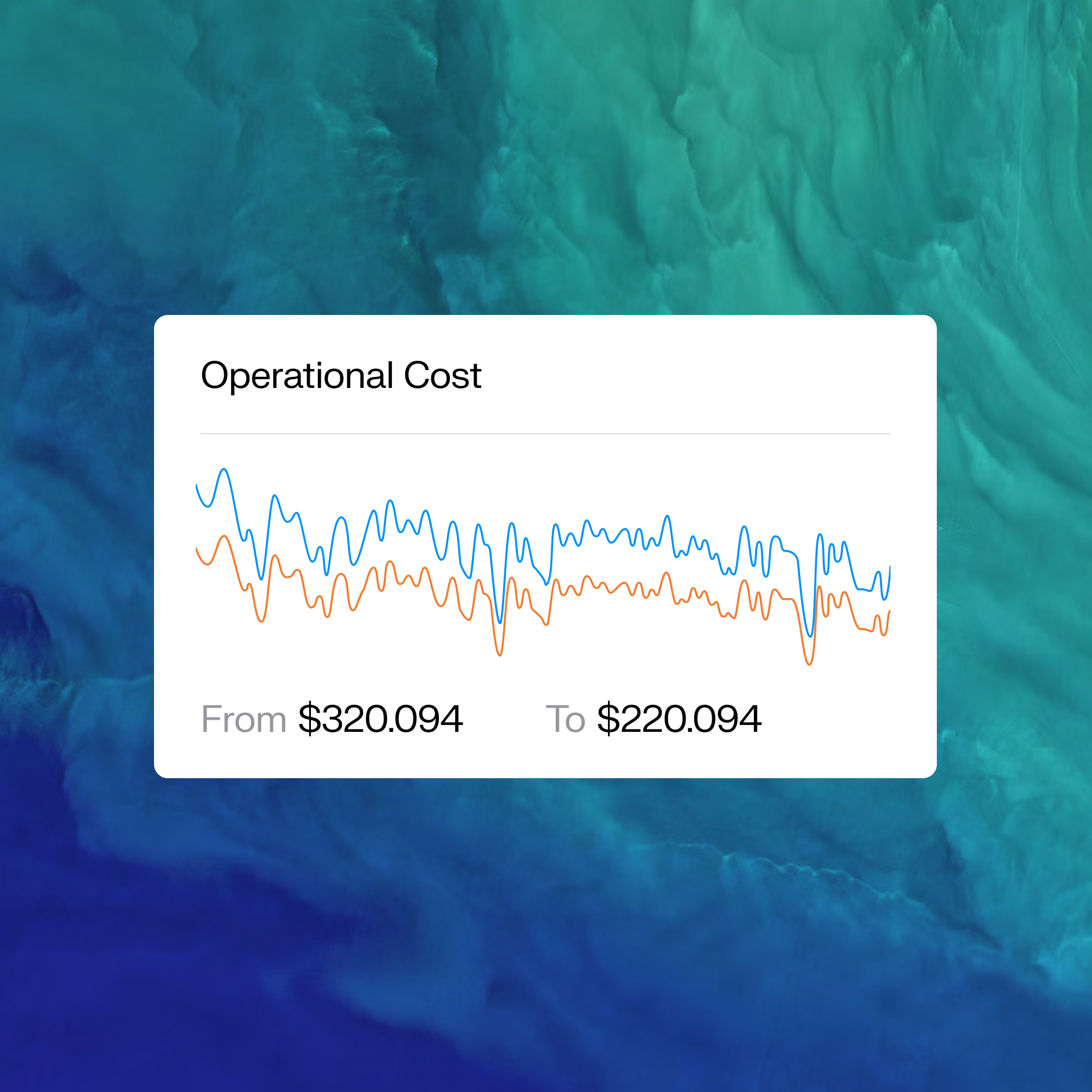

At the same time, electricity demand is accelerating. The EIA forecasts U.S. commercial sector electricity consumption will grow by 3% in 2025 and 5% in 2026, driven largely by data centers in ERCOT and PJM regions. The proliferation of artificial intelligence, cloud computing, and electrification of transport and manufacturing is creating new, concentrated sources of demand growth. Even as energy efficiency improves, the sheer scale of these new loads is outpacing gains. This growth necessitates new investment in generation, transmission, and distribution infrastructure, which utilities recover through higher rates. Federal Energy Regulatory Commission reports highlight that wholesale market hubs are already experiencing heightened volatility as supply tries to keep up.

The limits of alternatives

Some observers point to coal as a short-term relief valve. Indeed, higher gas prices are temporarily shifting some generation back to coal, with its share holding steady at about 16% in 2025. However, structural decline in the coal fleet, regulatory challenges, and limited appetite for new coal plants make this option unsustainable. Renewables are expected to grow from 23% of U.S. electricity generation in 2024 to 27% by 2026, led by solar and wind. Yet while renewables help offset fuel volatility, they require significant grid upgrades and storage deployment to provide reliable baseload power. Battery capacity is expanding rapidly, but it will take years before storage plays a large enough role to stabilize prices.