Business Implications of Rising Technology Costs

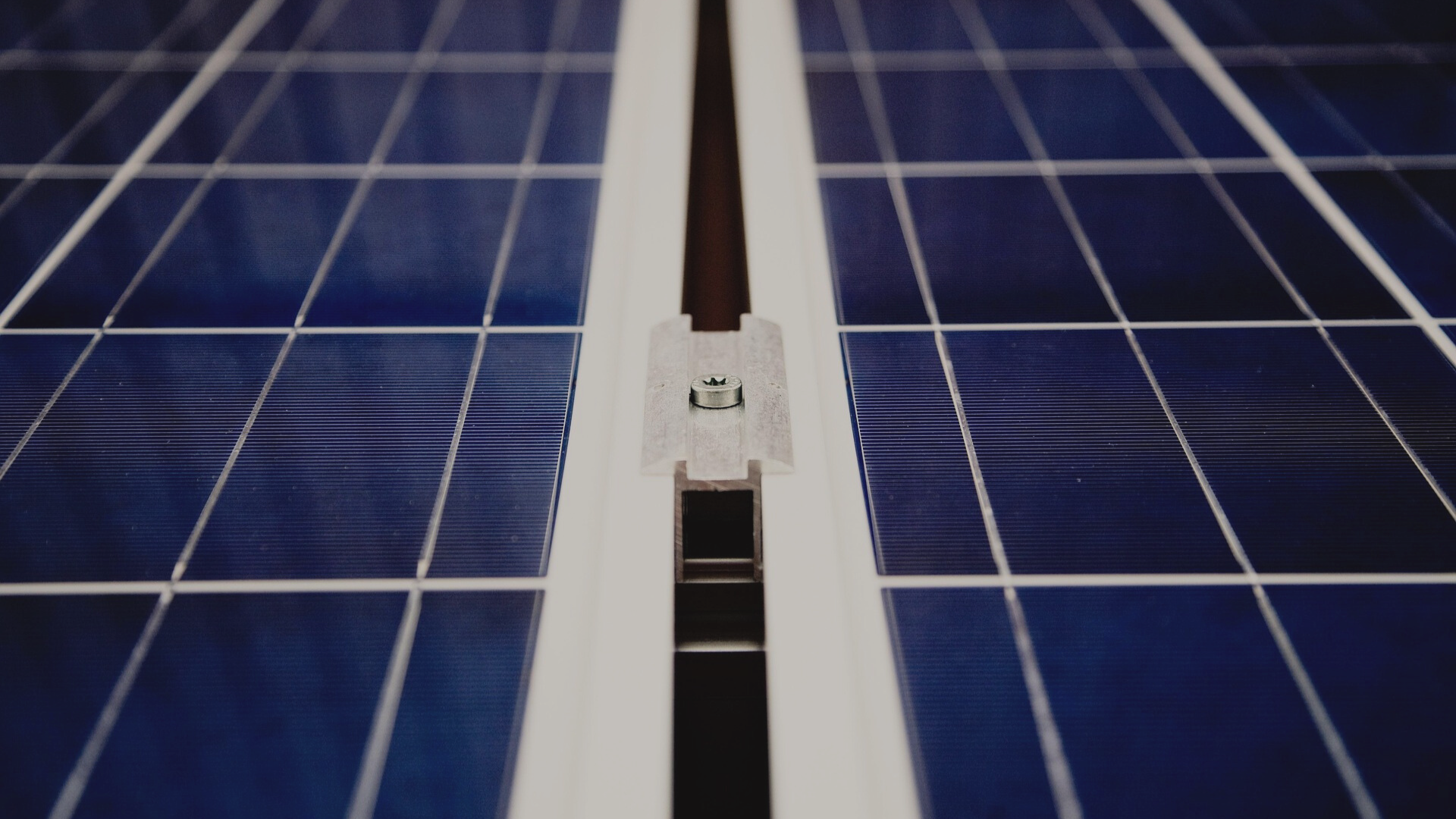

For companies in sectors with high energy demand, such as data centers, manufacturing, and logistics, the rising cost of renewable technologies has direct financial impacts. Payback periods for on-site solar installations lengthen, potentially reducing the attractiveness of corporate investments. Power purchase agreements (PPAs), which surged in popularity as renewables became cost-competitive with fossil fuels, may now present less favorable pricing, complicating long-term energy planning.

Sustainability commitments are also at risk. Many corporations have set ambitious Scope 2 emissions reduction targets, often relying on affordable solar and wind capacity to deliver. As clean energy procurement becomes more expensive, companies may need to weigh the trade-off between meeting climate goals and maintaining financial performance. This could create a two-tier system where larger corporations with significant resources continue to pursue renewables, while smaller businesses delay or reduce their commitments.

On a global scale, U.S. companies may face competitiveness challenges if international peers continue to benefit from cheaper access to renewable energy. Europe and parts of Asia, where supply chains remain more integrated with China, could see lower renewable costs relative to the U.S., influencing where global firms decide to invest in energy-intensive operations.

Alternative Pathways: Wind, Nuclear, and CCUS

While solar and battery costs are under pressure, other technologies present potential pathways for businesses seeking cost-effective clean energy. Wind energy, for example, remains a strong option. The U.S. has over 163,000 MW of installed wind capacity and several domestic manufacturers capable of supplying turbines. However, executive orders halting offshore wind leasing and limiting onshore development on federal lands threaten future expansion. Growth will largely depend on projects already under construction and state-level policy support.

Nuclear power is also re-emerging. Recent executive orders have accelerated the approval process for new nuclear plants, and projections suggest nuclear could account for 16% of U.S. electricity generation by 2030. Although nuclear faces challenges related to financing, safety perceptions, and construction timelines, it offers businesses a reliable, low-carbon alternative to fluctuating renewable markets.

Carbon capture, utilization, and storage (CCUS) technologies represent another option. The U.S. leads globally, with 275 active and upcoming projects compared to 526 worldwide. With tax incentives such as the 45Q credit still intact, CCUS can help energy-intensive industries reduce emissions without depending solely on renewables. While not a substitute for clean energy generation, CCUS provides flexibility and could become an increasingly important component of corporate decarbonization strategies.