What Businesses Can Do to Adapt

Even as federal support for clean energy wanes, companies still have ways to reduce risk and manage rising energy costs:

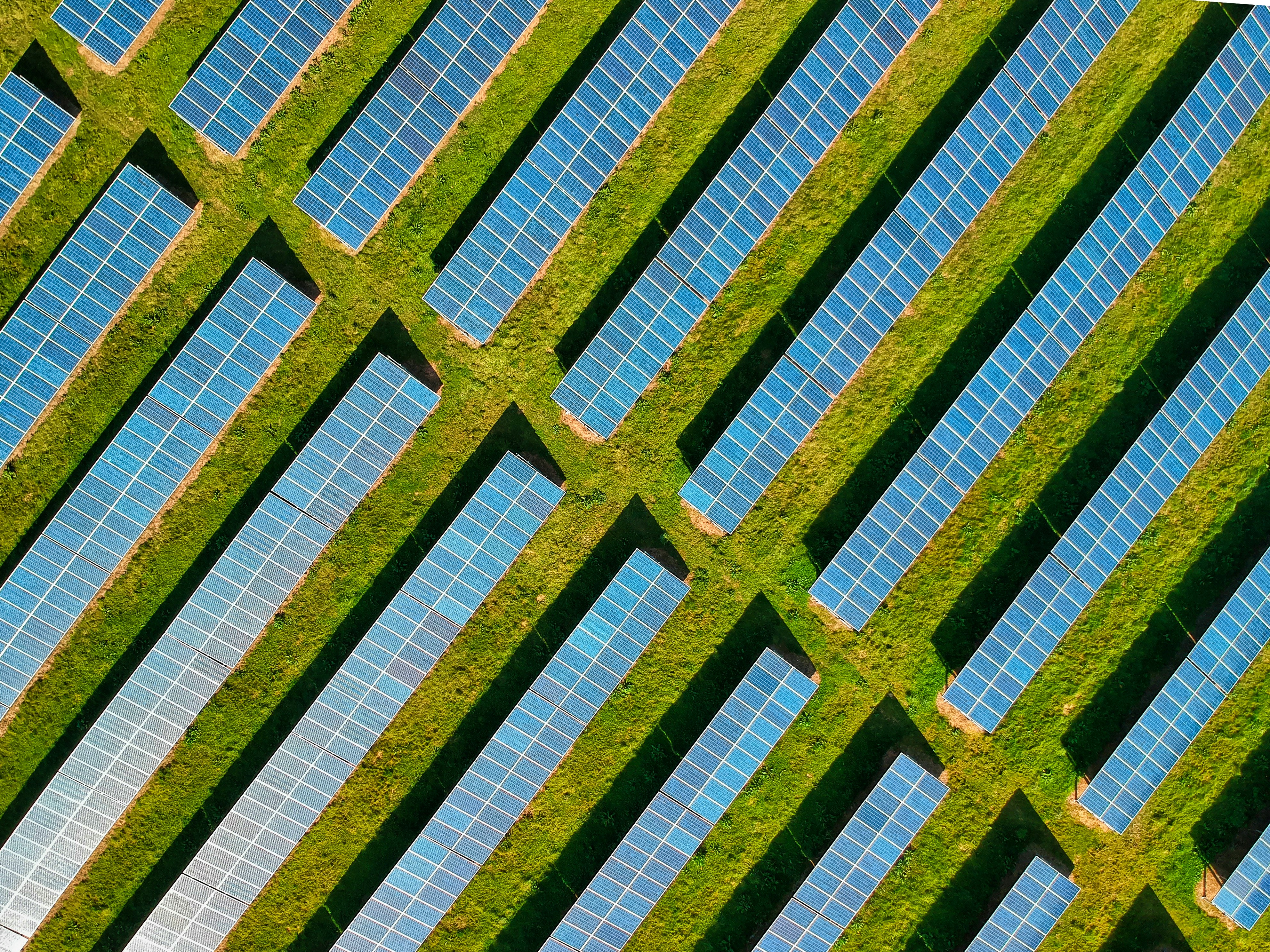

1. Diversify energy sources Businesses should look beyond federal policy and consider partnerships in states that maintain strong clean energy programs. States like California and New York continue to offer incentives for renewable energy projects.

2. Improve energy efficiency Investing in energy-saving technologies, equipment upgrades, and smart building systems can reduce overall consumption and protect against price increases. To manage risk, performance-based contracting is often an available option.

3. Stay engaged with policy developments Companies should monitor regulatory changes closely, especially Treasury and IRS guidance on what remains of the IRA. Legal consultation can help navigate evolving compliance rules.

4. Focus on transparency and resilience Despite federal policy shifts, international expectations on climate disclosure remain high. Aligning with global standards like TCFD or CSRD can preserve access to green financing and help manage reputational risk.

Planning for an Uncertain Energy Future

The IRA was designed to provide long-term stability for clean energy investment. Under the current administration, the policy landscape has shifted, bringing new variables and potential changes in cost structures. While fossil fuel production may expand in the near term, global efforts toward decarbonization continue to influence market direction.

For companies, the key is to remain flexible and forward-looking. By investing in efficiency, engaging with state-level programs, and planning for long-term energy resilience, businesses can navigate this shifting landscape—and still make progress on sustainability and competitiveness.

References: